LeClinic's

Nuestro equipo de profesionales se encargarán de atenderte de la mejor manera en nuestras clínicas estéticas, y resolverán todas tus dudas

Profesionales

Conoce a nuestro equipo

Dr. Corrales

CIRUGÍA PLÁSTICA, ESTÉTICA Y REPARADORA

Nº de Colegiado: 282870870

Dr. de Nicolás

CIRUGÍA PLÁSTICA, ESTÉTICA Y REPARADORA

Nº de Colegiado: 282853771

Dra. Bezares

CIRUGÍA PLÁSTICA, ESTÉTICA Y REPARADORA

Nº de Colegiado: 444402603

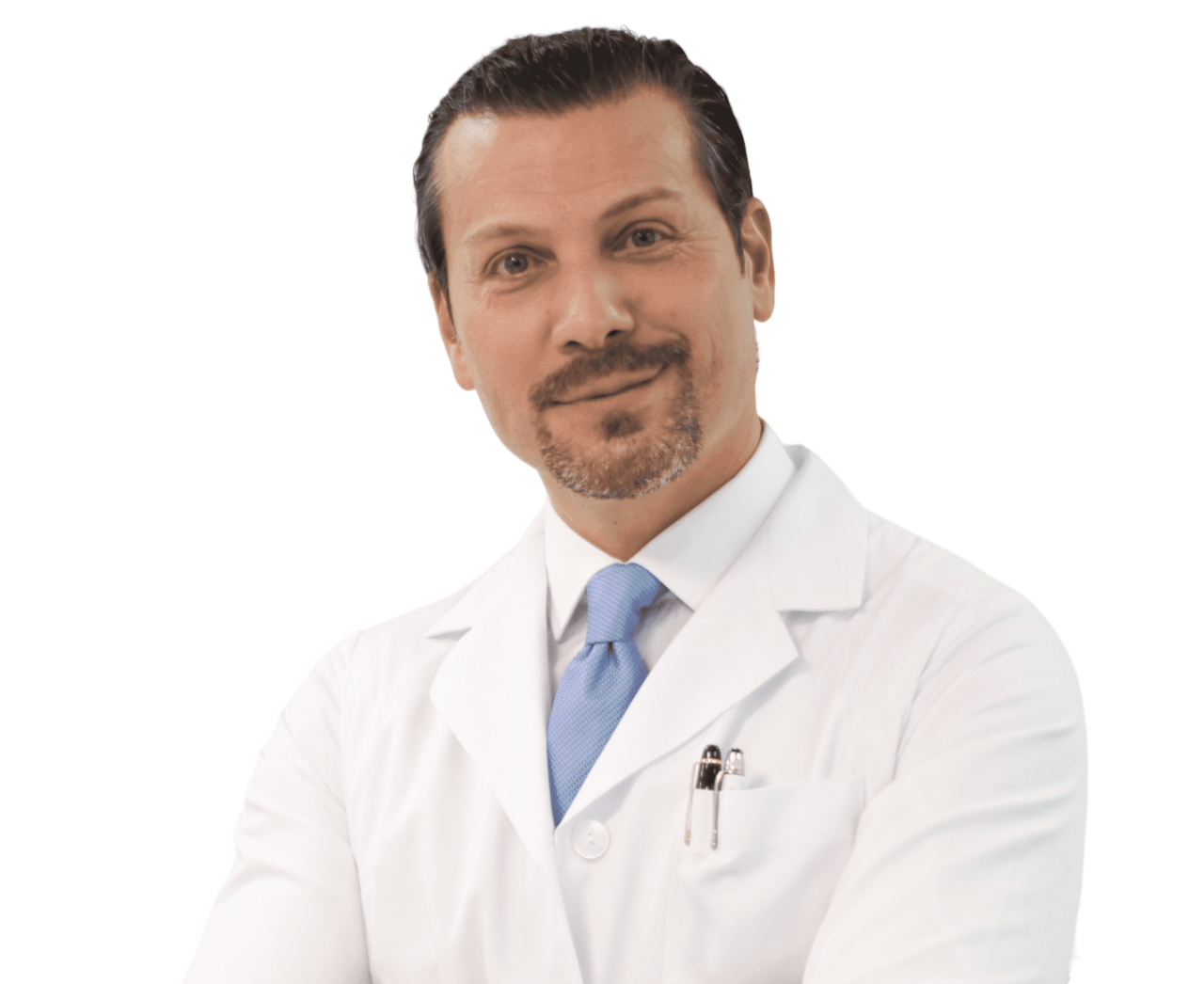

Dr. Bayton

MEDICINA ESTÉTICA

Nº de Colegiado: 282877428

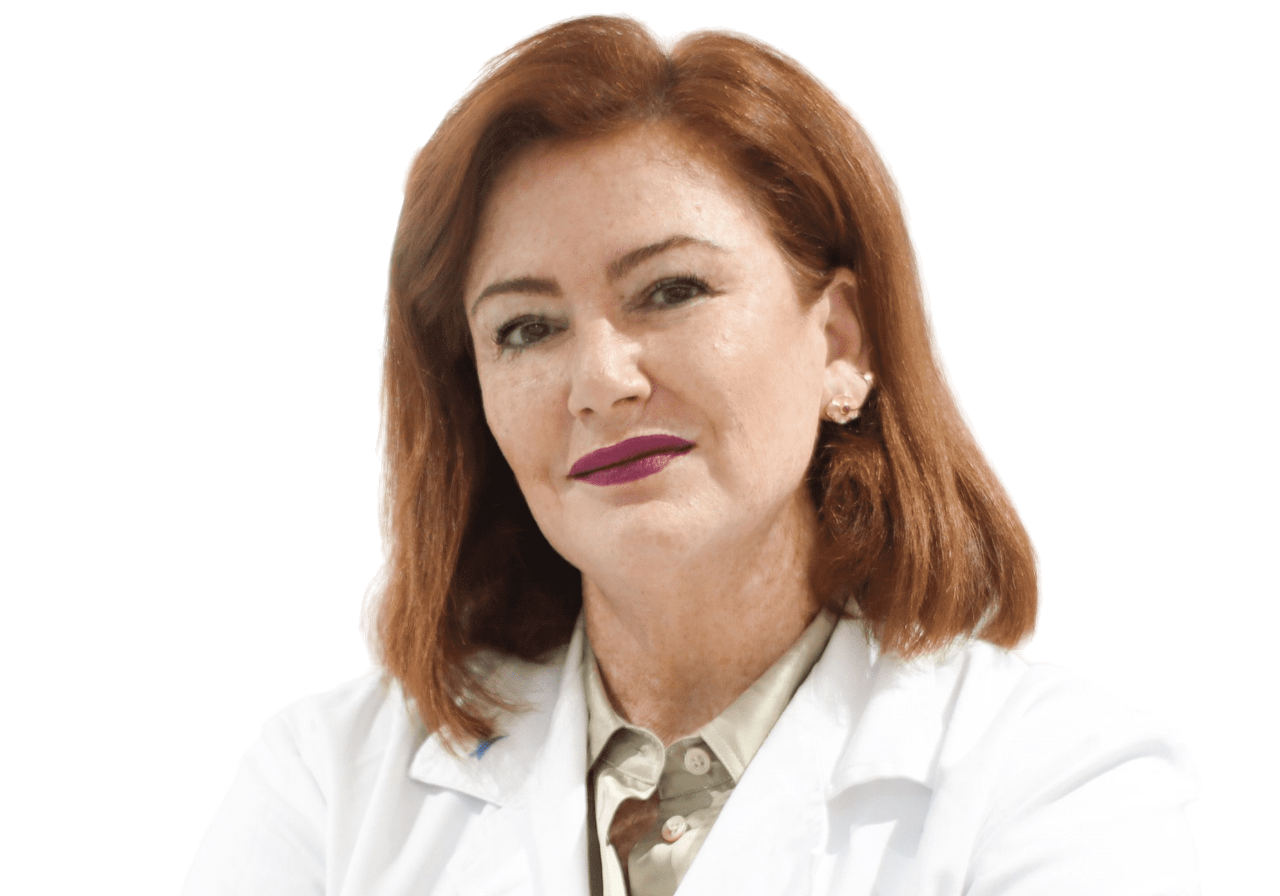

Dra. Palma

MEDICINA ESTÉTICA

Nº de Colegiado: 292904342

Dra. Melanie García

MEDICINA ESTÉTICA

Nº de Colegiado: 284306742

Descuentos en nuestra tienda

Promociones tratamientos

Si necesitas otro tipo de consulta:

Blog

Consejos de Belleza y Salud

¡Tenemos la suerte de tenerte como paciente!

Si tienes un minuto, nos ayudaría mucho que nos dejases una reseña sobre tu experiencia en este enlace:

Experiencias

Comentarios de pacientes

Videos

Resultados inmediatos

Aumento de labios con Ácido hialurónico

Alta cosmética

Skin Clinic

Cuida tu piel con la gama de productos de alta cosmética que ofrecemos en nuestra tienda online

Promociones y descuentos

Aprovecha los descuentos que te ofrecemos en compras realizadas en la Web.

Envíos y devoluciones gratis

Infórmate de nuestro rango de alcance para el envío de nuestros pedidos.

Privacidad

Todos los datos registrados en las compras serán tratados con total privacidad de usuario.